Taxes

The Total Tax Burden of the Top 1% is discussed on this webpage.

In a video unearthed on September 17, 2012 by Mother Jones magazine, Republican presidential candidate Mitt Romney was captured making some inflammatory comments about the 47% who don't pay income tax in America.

A great deal has been written about Romney’s comments, and there is a great deal of confusion in this country about who supports the government and the economy, and about who benefits most from our current tax system. You may find the tax data below interesting.

If you're a resident of the United States, and if you had an adjusted gross income greater than $500,000 during 2010, then that put you in the top 1% of all filers in the US during 2010.

Almost everyone knows that the top 1% pay almost 30% of all income taxes collected by the Internal Revenue Service because that fact has been endlessly repeated by the mainstream media. Sometimes it is simply reported as the top 1% pay 30% of the taxes.

But how much of ALL the taxes collected by the IRS do the Top 1% pay?

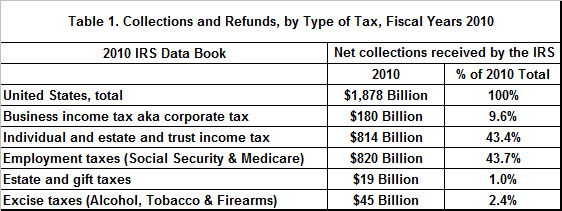

Table 1 below shows the five taxes collected by the Internal Revenue Service. This table was published in the 2010 IRS Data Book.

The data in Table 1 above surprised me. They show that the largest tax collected by the IRS for fiscal 2010 was NOT an income tax, but an employment tax, also known as Social Security and Medicare taxes. The top 1% are essentially exempt from paying Social Security taxes because they are applied to earned income, but not investment income, and they were capped at $106,800 during 2010. Medicare taxes are applied to all earned income, but not investment income.

Employment Taxes also known as Social Security and Medicare Taxes are used for a variety of purposes other than pensions and medical care for senior citizens.

The larger and better known Social Security programs are:

Federal Old-Age (Retirement), Survivors, and Disability Insurance

Some unemployment benefits

Some

Temporary Assistance for Needy Families

Health Insurance for Aged and Disabled (Medicare)

Grants to States for Medical Assistance Programs (Medicaid)

State Children's Health Insurance Program (SCHIP)

Patient Protection and Affordable Care Act

The middle classes and the working poor pay for these programs when they pay employment taxes, but the top 1% are essentially exempt from paying for them.

That means the burden of caring for those that cannot care for themselves is carried by the working poor and the middle classes.

Regardless, the bottom line is that the top 1% received 18.58% of adjusted gross income, but paid less than 1% of Social Security and Medicare Taxes during 2010.

When that fact is factored into ALL the taxes that are collected by the IRS, the result is that the top 1% received 18.58% of the adjusted gross income, but they paid about 17% of all taxes collected by the IRS during 2010.

Warren Buffett's and my data show that those with an adjustable gross income from $30,000 to under $500,000 pay much more federal tax than the top 1% in both percentage and absolute terms. Filers with an adjusted gross income under $30,000 do not contribute a great deal of income tax to the IRS, but they are making substantial contributions to Social Security and Medicare.

Also recognize that there are many other taxes collected by our various governments that are disproportionally borne by the poor and middle classes. Examples are property taxes, sales taxes, fuel taxes, import taxes, telecommunications taxes, unemployment taxes, workers compensation taxes, hotel and car rental taxes, utility taxes etc.

These are primarily consumption taxes that are paid by all consumers, but the top 1% generally consume only a small part of their income. That means that these taxes are extremely regressive, and it means the top 1% do not pay nearly as much as the poor and middle pay in both absolute and percentage terms.

The very rich are different from you (probably) and me:

They have more money and income, but they are taxed at much lower rates.