WEIMERandWIRTH Newsletter History and Description

Subscriptions to WEIMERandWIRTH are no longer available

Henry Wirth retired from the newsletter business on June 30, 2015

Doug Weimer retired from the newsletter business on

December 31, 2011

For whatever it's worth, at this point I'm convinced that a financial newsletter is not worth a great deal of effort i.e., if you can really beat the market, then the return of your investments is almost certainly going to be much greater than the return of any newsletter you are likely to manage.

I am also convinced that a scientific investment decision making strategy and the intestinal fortitude to follow the strategy are essential, but luck is probably equally important. For a brief explanation of a scientific investment decision making strategy go to Index Funds

Unfortunately, I also believe the chance of a growth and momentum strategy adding a great deal of value in an environment dominated by disappointing growth, fear, uncertainty and rising interest rates is slim to none, but I'm still trading stocks because hope springs eternal.

Write to [email protected] if you have questions.

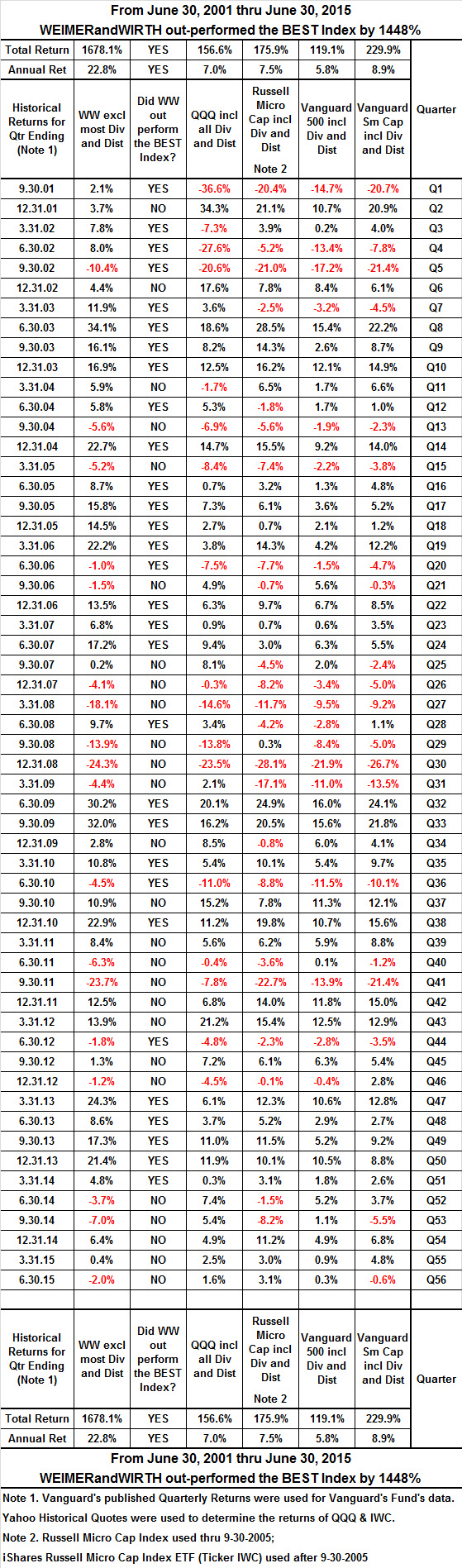

The table below shows the Quarterly, Annual and Total Returns of WEIMERandWIRTH, the S&P 500, the NASDAQ 100 (QQQ), the Russell Micro Cap Index and the Vanguard Small Cap Index for the 14 year life of WEIMERandWIRTH.

The most appropriate benchmark for WEIMERandWIRTH is the Russell Micro-Cap index.

The returns shown for WEIMERandWIRTH (WW) hypothetical model portfolio are returns that would have been realized if transactions had been executed on the first trading day after the recommendations were made to WEIMERandWIRTH subscribers.

The WW Model Portfolio consisted of a sixty stock portfolio that was turned over about four times per year. The average holding period for each of the stocks in the portfolio was about three months.

The average high-low prices of WW purchases were increased by 1/2%,

and the average high-low prices of WW sales were decreased by 1/2%

to account for transaction costs. Dividends are not included in the

returns.

WEIMERandWIRTH System Description

We look for stocks that have increased earnings and that have positive price momentum. During the nineties, before we shared results with anyone, Doug Weimer concentrated primarily on large cap NASDAQ tech stocks. I began monitoring his system in late 1997.

After the crash of 2000, Doug's portfolio held up reasonably well, while the bottom fell out of the NASDAQ and everything else. After June 2001 we began sharing our results with anyone who wanted them, and I began investing in WW stocks. I'm glad I did.

Once again, at this point I'm convinced that a scientific investment decision making strategy and the intestinal fortitude to follow the strategy are essential, but luck is probably equally important. Unfortunately, I also believe the chance of a growth and momentum strategy adding a great deal of value in an environment dominated by disappointing growth, fear, uncertainty and rising interest rates is slim to none, but I'm still trading stocks because hope springs eternal.